Banks are opting for bonds to raise their capital in line with Basel III requirements for their cost-effectiveness, instead of floating more shares on the stockmarket.

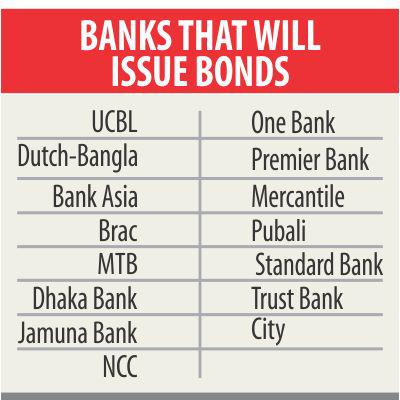

In the past two years, 14 banks have issued subordinated bonds worth Tk 6,400 crore to strengthen their capital base.

A subordinated bond is a debt that is ranked below other debt in terms of claims on assets. In case of a default, the holder of a subordinated debt cannot satisfy claims on the borrower's assets until the claims of the holders of senior debt are met.

The interest rate banks offered against the bond was between 7.50 percent and 10.50 percent.

The subordinated bonds are non-convertible and redeemable, and institutions can invest in the bonds for seven years.

The bonds will be sold through private placement to other than existing shareholders, according to Dhaka Stock Exchange.

The low interest rate opened up the opportunity for banks to raise capital at a low cost, said a senior executive of the Bangladesh Bank.

The interest rate on fixed deposits came down to 5 percent due to a lack of credit demand and excess liquidity. Banks are offering interest rate of more than 7 percent for their bonds.

On the other hand, if banks go to the capital market for mobilising funds they will have to offer more than 10 percent dividend to remain in the “A” category stocks.

Only two banks have announced their intent to raise capital through issuing rights share, according to the DSE.

“Moreover, shareholders expect higher dividend from banks,” the BB official said, adding that the scenario was opposite several years ago when the interest rate was more than 15 percent.

As a result, the capital market then was less expensive than bonds for raising funds. For instance, around 2008-09, many banks issued rights shares to expand their business. “The stockmarket was on song then,” he added.

City Bank recently announced its intent to issue subordinated bonds worth Tk 500 crore to meet capital requirements as per Basel III rules. The bank informed through a posting on the DSE website that each bond will be sold at Tk 1 crore through a private placement to investors.

“This process is cost effective and easier,” said Mashrur Arefin, additional managing director and chief communication officer of City Bank.

If the bank issues rights shares or gives stock dividends, it will dilute shares and put a negative impact on dividend, he said. City is complaint with the existing capital requirement and is raising funds for business expansion.

A rights issue is an offer of new shares to existing shareholders in proportion to the shares they already own and usually at a discount to market price. “Bond is now a lucrative investment tool as the return is higher than FDR,” said Kazi Masihur Rahman, managing director of Mercantile Bank, which is planning to raise capital by way of subordinated debt.

Banks will have to maintain capital at 12.50 percent of risk-weighted assets, according to Basel III framework. The BB has set the deadline of 2019 for meeting the required capital base. As of March, the banking sector's capital adequacy ratio is 10.68 percent, according to the central bank.

news:daily star/10-jul-2017

Comments