Stocks return to the black

Stocks returned to the black yesterday, breaking a three-day losing streak, as investors took fresh position in the market amid optimism.

Stocks returned to the black yesterday, breaking a three-day losing streak, as investors took fresh position in the market amid optimism.

DGEN, the benchmark general index of Dhaka Stock Exchange, finished the day at 4,589.33 points, after surging of 44.93 points or 0.98 percent.

The market gauge slipped 53 points within 10 minutes of the opening hour of trading. Turnover on the DSE floor rose 0.19 percent to Tk 783 crore than the previous day.

A total of 1.72 lakh trades were executed with 21.18 crore shares and mutual fund units changed hands on the Dhaka bourse.

“A total of 34 companies generated more than 7 percent gain. Top 20 traded stocks dominated the market activity. Top 20 traded companies had a total turnover of Tk 377 crore, which is equivalent to 48 percent of the day's total turnover,” said LankaBangla Securities, a leading stockbroker.

Of the 274 issues that traded on the DSE, 215 advanced, 53 declined and six remained unchanged.

Among the major sectors, banks gained the most, went up 1.87 percent followed by telecom 1.37 percent, non-bank financial institutions 0.61 percent and pharma 0.25 percent.

United Airways topped the turnover leader for the third day with 3.20 crore shares worth Tk 100.6 crore changed hands on the premier bourse.

RN Spinning Mills and Bangladesh Submarine Cable Company were the next popular stocks of the day.

CMC Kamal was the biggest gainer of the day, posted a 10 percent rise while Delta Spinners was the worst loser, slumping by 7.14 percent.

News: The Daily Star/Bangladesh/2nd-Oct-12

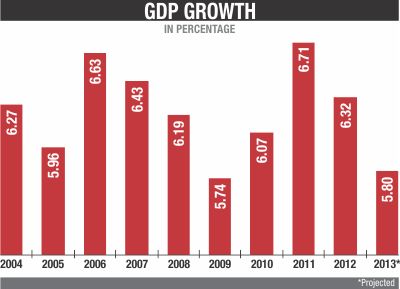

Economic growth to slow to 5.8pc: IMF

Bangladesh's economic growth may slow down to 5.8 percent in the current fiscal year, largely due to sluggish exports and investment, the International Monetary Fund forecast.

Bangladesh's economic growth may slow down to 5.8 percent in the current fiscal year, largely due to sluggish exports and investment, the International Monetary Fund forecast.

A finance ministry official said an IMF mission made the forecast last month after a two-week review of Bangladesh's latest macro-economic situation.

The government set the GDP growth target for the current fiscal year at 7.2 percent.

In June, Finance Minister AMA Muhith in his budget speech said the trend of satisfactory growth will continue in the commerce and agriculture sectors in 2013 as the global economy is on the rebound.

He also said the productive sectors would get enough credit supply and the deficit in the power and energy sectors would come down.

According to the central bank statistics, like the previous year, slow growth in exports will continue this year. In July, export growth was 4.26 percent and in August it came down to 3.63 percent.

Nasir Uddin Chowdhury, the first vice president of Bangladesh Garment Manufacturers and Exporters Association, earlier told The Daily Star that exports might be slow in September.

The exporters said an economic slowdown in the EU and the US is mainly responsible for a sluggish trend in exports.

According to Bangladesh Bank data, the opening and settlement statistics of letters of credit for import of capital machinery and industrial raw materials also show a slow trend in investment.

Last fiscal year also, LG opening for import of capital machinery fell by 21.22 percent, while LC opening for im-porting industrial raw materials went down by 3.84 percent.

The negative trend continued in the current fiscal year as well. In the first month of the current fiscal year, LC opening for import of capital machinery fell by 30 percent, and for industrial raw materials the decline was 0.63 percent.

However, a BB official said the central bank is now encouraging credit flow to productive sectors under its new monetary policy.

The official said the GDP growth in the current fiscal year will be more than 6 percent.

Though the IMF predicted that the economic growth will be lower than the government's target, the lender said inflation will remain within a single digit.

The IMF mission said inflation will remain close to the government's target of 7.5 percent, according to the BB official. However, the lender is concerned about food inflation as the prices of food commodities are rising on the international market.

The IMF team expressed satisfaction over the central bank's monetary policy, saying it is in the right direction to curb inflation. The IMF encouraged the central bank to continue it, the BB official said.

News: The Daily Star/Bangladesh/2nd-Oct-12

Pubali Bank course on internet banking, remittances held

A daylong Training program on "Internet Banking, Remittances, CIB Reporting & Customer Registration" was held in the Pubali Bank Head Office organised by Information Technology Division recently. Managing Director of Pubali Bank Helal Ahmed Chowdhury was present as the chief guest.

Additional Managing Director M.A. Halim Chowdhury was present as special guest. General Manager & Chief Technical Officer Mohammad Ali presided over the workshop.

News: The Daily Financial Express/Bangladesh/30-Sep-12

DBBL CSR event on plastic

Under the DBBL "Smile-Brighter" programme, Dutch-Bangla Bank has organized a 4 day long plastic surgery operation camp in Dhaka City for the poor cleft-lips and palate boys and girls to bring back the endearing smile on their faces through plastic surgery at free of cost.

KS Tabrez, Managing Director of Dutch-Bangla Bank inaugurated the operation camp at South View Hospital at Mirpur on September 16, 2012. 60 patients have been enlisted for surgery during the camp. A plastic surgery team headed by eminent plastic surgeon Dr. A. J. M. Salek has been conducting the operation.

KS Tabrez visited the operation camp and inquired about the pre-operative cleft-lipped boys & girls at the hospital. In this connection, a discussion meeting was held at the conference room of the hospital. In a brief speech, the Managing Director of the Bank mentioned that, DBBL, over and above its regular business activities, always reaches to the destitute of the country by way of carrying out a wide range of social causes activities related to education and health of the underprivileged children and extending financial assistance to distressed and calamity affected people.

News: The Daily Financial Express/Bangladesh/30-Sep-12

BRAC Bank launches Internet Banking services for corporate clients .

BRAC Bank Monday launched Internet Banking service that can be custom tailored for its corporate clients to enable them to effect wide array of transactions just by a click over Internet that will speed up business operations.

This is the first such service among private local banks in Bangladesh for corporate entities that facilitates payment services through fund transfer, bulk payment including salary disbursement, standing instruction set up within BRAC Bank network. BRAC Bank has plans to expand the service so that companies can send L/C requests. Once Bangladesh Electronic Fund Transfer Network (BEFTN) integration is up this payment services will be expanded for domestic transfers within banking group network.

With BRAC Bank Internet Banking, companies can set up automatic bill payments, initiate future dated transactions apart from getting account statement, transaction history and viewing pending and rejected transactions. In coming days, the companies will also view summary of outstanding L/Cs and Bills with amounts in preferred currency.

BRAC Bank Internet Banking is fully safe and secure as globally used technology of two factor authentication - OTP (One Time Password) is deployed that generates random passwords for each transaction.

Ms Nazneen Sultana, Deputy Governor, Bangladesh Bank, formally launched the service at a program at a city hotel in the city Monday. Mr Syed Mahbubur Rahman, Managing Director & CEO; Mr Mahmoodun Nabi Chowdhury, Head of Corporate Banking; and senior officials of BRAC Bank Limited attended the programme.

Mrs. Nazneen Sultana, Deputy Governor, Bangladesh Bank, lauded BRAC Bank for initiating the IT-enabled service for business entities for smooth and speedy business transactions.

Mr. Syed Mahbubur Rahman, Managing Director & CEO; BRAC Bank, said, "Corporate houses can now bank with us at anytime from any place. They do not need to wait for Sunday morning for cheque encashment to party. They can do it even on weekend's right from a computer at any place. It will definitely bring new dynamism to their business operations and productivity."

"As a tech-savvy bank, BRAC Bank always comes forward with new technology for smart and smooth services to the clients. This pioneering service shows our strong commitment to introduce modern banking services to cater to modern day needs of business entities," he continued.

News: The Daily Financial Express/Bangladesh/30-Sep-12