Mobile banking sees stellar growth

Transactions rose 53pc last year

Mobile banking in Bangladesh continues to grow fast, scaling a new height last year with 53 percent growth year-on-year.

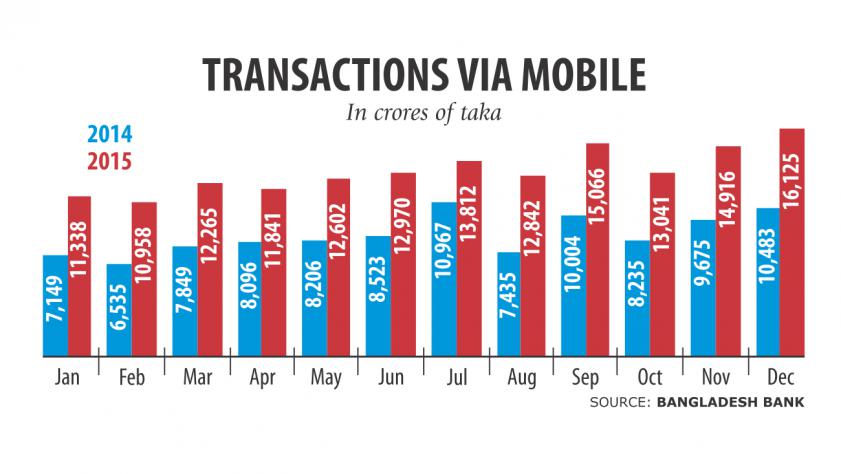

In 2015, the industry saw Tk 157,773.31 crore in transactions through mobile phones -- the amount being more than half the country's national budget, according to a report of Bangladesh Bank.

In 2014, the mobile banking industry saw Tk 103,155.37 crore in transactions.

People are becoming increasingly comfortable with the banking platform, analysts said.

The average monthly transactions made through mobile phones stood at more than Tk 13,147.77 crore last year, rising from Tk 8,596.28 crore in 2014.

“In the last couple of years, we have observed that people at the bottom of the pyramid are also massively taking part in economic activities and that volume is increasing significantly every day. This contribution directly impacted the transactions in mobile banking,” said Subhankar Saha, a BB executive director.

The central bank said the volume is quite natural and there is scope for further growth.

aha, who is also the BB spokesperson, said they are expecting more than 30 percent growth in 2016.

The central bank plans to strengthen security measures this year, Saha added.

“There are about 3.19 crore mobile banking accounts and this figure will increase in the coming days; the total volume of transactions will also rise,” he said.

Of the total accounts, only 1.25 crore are active users, according to the BB report.

People are mainly using this modern banking channel to transfer money domestically.

But the opportunities to use this channel to deposit government fees and charges and make purchases are yet limited, he said. Last year, the sector saw Tk 27,879.56 crore in person-to-person money transfers, and the amount was only 17.67 percent of the total transaction. The figures for business transaction, salary disbursement, and bills payments were also nominal.

Saha said entrepreneurs have to work in these areas.

However, the market leader in mobile financial services -- bKash -- said customer-centric products along with the trust and confidence of common people have helped the sector grow.

“Besides fund transfer services, we are offering 'buy airtime' for mobile top-up, merchant payments at shops, salary disbursement and different collection solutions for corporate customers, which have contributed to our growth,” said Zahedul Islam, the spokesperson for bKash.

Earlier in a report USAID said Bangladesh has a rapidly growing mobile financial service industry, accounting for more than 8 percent of the total registered mobile money accounts globally.

The country launched such products in 2011 and in five years, the market hit the highest position in the world so far.

Currently, 28 banks have approval for offering mobile financial service although 20 launched operations so far. Two leading operators hold around 90 percent market share.

News:The Daily Star/3-Feb-2016Other Posts

- Ready to back US firms in Bangladesh, says Exim Bank boss

- Vietnamese bankers arrested over fraud 'worth millions'

- Sonali, Basic Bank needs time to regain positions: Muhith

- UCBL signs agreement with SHAKIB’s

- EBL launches commercial payment solution

- PBL holds Managers' Confce of Noakhali Region

- BRAC Bank holds 2-day Strategy Session

- FSIBL congratulates BB governor Atiur Rahman

Comments