Merge weak banks with strong ones: analysts

The government should consider merging weak banks with the strong ones for the betterment of the sector and the economy, analysts said yesterday.

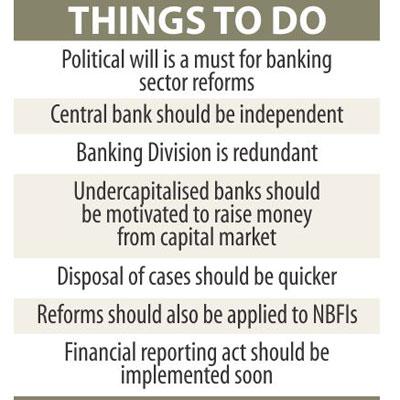

They also stressed political will, which is the key to establishing governance and accountability in the banking sector, particularly in the corruption-prone and capital-starved state banks.

The analysts made the observation at a roundtable styled 'Banking sector of Bangladesh: Reforms and governance', organised by Dhaka Forum, a civil society organisation, at the capital's Brac Centre Inn.

“Bangladesh needs to pursue a merger of some banks for stability of the entire sector,” said AB Mirza Azizul Islam, a former adviser to the caretaker government.

He also criticised the government for allowing too many banks -- 56 -- in a relatively small economy.

When the banks' business volume is low, they tend to charge high for making profits, said Islam, who chaired the programme.

Bangladesh Bank introduced guidelines on merger and acquisition of banks and finance companies in 2006, but no such merger took place yet.

In contrast, there have been as many as 34 mergers and acquisitions so far in the banking and finance sector in India.

There were at least 25 cases where private sector banks merged with the public sector banks.

In post-1999, however, even healthy banks were merged upon business and commercial considerations.

Salehuddin Ahmed, president of Dhaka Forum, urged the government and the central bank to deal with the merger issue strongly.

“To put it simply, 56 banks are not viable in Bangladesh,” said Ahmed, who is also a former BB governor.

Farooq Sobhan, president and chief executive of Bangladesh Enterprise Institute, echoed the same concern about having too many banks in the economy.

He cited the example of Malaysia, which brought down its total number of banks to just 6 from 16 in recent years.

Sobhan, also a former diplomat, criticised the double standards applied to the private and public sector banks.

Experts were also critical about the poor independence afforded to the country's central bank.

“Politicisation of the boards of the state-owned banks is a mess,” Islam said, adding that the state-owned banks should be listed on the stock exchanges with at least 49 percent stakes to increase their transparency and accountability.

The central bank should be given more autonomy and independence and its supervision should be separated from its monetary policy stance. The economist also warned the banks about the rising nonperforming loans, which can be dealt by appointing asset management companies.

Ahmed said the health of the banking sector would deteriorate without proper governance and accountability.

Political consideration should not be a factor in dealing with the banking industry, which is a highly technical domain, he said.

Toufic Ahmad Choudhury, director general of Bangladesh Institute of Bank Management, said creating a banking and finance division within the finance ministry has weakened the central bank.

On the scams in the state banks, he said the banking division should be held responsible for those.

He also sees weakness in the political will to carry out reforms in the state banks.

“Without a strong political will, it is not possible to restructure the state banks,” Choudhury added.

Biru Paksha Paul, chief economist of the central bank, said the private banks' average NPL is below 5 percent, whereas it is more than 20 percent for state banks.

He said the BB should have the power to regulate all kinds of banks in the country.

Syed Abu Naser Bukhtear Ahmed, a former managing director of a number of banks, presented a keynote paper.

News:The Daily Star/18-Jan-2016

Other Posts

- Dr. Zaid Bakht, Chairman of Agrani Bank poses at Zonal Heads and Corporate Branch Heads Conference-2016 in the city on Saturday.

- Banks need to free from political pressure

- NBL holds meeting on credit management

- Shahjalal Islami Bank “Managers’ Conference-2016” held

- FSIBL & Transfast signes Remittance agreement

Comments