Once a highly sought-after client, Chittagong-based Mohammad Elias Brothers Group, known as MEB Group, has now become the bane of the banking industry.

The group recently grabbed headlines by coming first on the list of top 100 loan defaulters in the country.

Though Finance Minister AMA Muhith did not disclose MEB Group's default amount, The Daily Star has found that the company has defaulted on its loans with 18 financial institutions, the total of which comes to about Tk 870 crore.

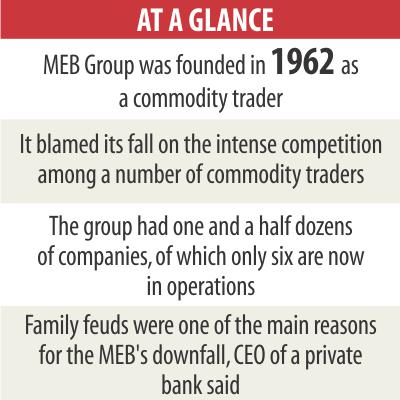

Founded in 1962 as a commodity trader, MEB Group later spread its wings to textiles, glass, plastics, paper mills, auto bricks, edible oil and beverages.

It went on to set up one and a half dozens of companies, of which only six are now in operations. The rest were either shuttered or non-operative because of financial constraints.

The group blamed its fall on the intense competition among a number of commodity traders that compelled them to sell goods at prices lower than the import costs between 2001 and 2010.

“MEB was forced to do the same and it accumulated our losses and bank loans,” said Mohammad Shouib Riad, managing director of MEB Industrial Complex.

Secondly, MEB Group had incurred huge losses during the last caretaker government regime in 2007-08, which pressurised the commodity trader to import huge quantities of edible oil at a much higher price, he said.

Later, the group had to sell the commodity for almost half of the cost, which yielded losses of about Tk 400 crore.

“We had to buy crude oil at $1,300 a tonne and sell those at only $700,” said Riad, who joined the family business in 2005 after completing his studies abroad.

Now, the group has retreated from commodity trading, its core business until 2009-10, altogether.

Also, The Daily Star found mismanagement soon after the death of MEB Group's founder Mohammad Elias in 1993.

The group was founded as a company of four brothers, who have a number of sons and daughters. The third generation too got involved in the family business after 2005.

“Family feuds were one of the main reasons for the MEB's downfall,” said a chief executive officer of a private bank that is owed nearly Tk 40 crore.

Riad too acknowledged mismanagement in the running of the family business. “We could have managed better, but we were not able to do so,” he said. The CEO of the bank has a first-hand experience in dealing with MEB Group, both during its ascent and descent.

“In the 80s and 90s, we ran after MEB to give them loans. They were the reputed and the most in-demand clients for banks at that time,” said the banker who worked for a foreign bank in Chittagong then. Now the irony is that banks shy away from lending to this business house, he said.

Involvement in politics of Shamsul Alam, son of Elias and current managing director of MEB Group, in 2008 has also taken a toll on the family business.

Alam, after failing to get the nomination from Awami League in the 2008 elections, joined BNP and became vice-president of the Chittagong city unit.

Riad though is still hopeful of overcoming the crisis and bringing the group back to its glory days.

He cited the Mohammad Elias Brothers Oil Refinery Plant as a case in point. The plant was established with the group's working capital and there is no loan against the project.

Nurul Absar, chairman of the group, could not be reached for comments.

News:Daily star/18-jul-2017

Comments