Corporate tax from banks goes down

Banks gave 32 percent less corporate tax to the national exchequer in 2013 than in the previous year due to an increase in their bad loans and shrinking of business owing to political turmoil.

Banks gave 32 percent less corporate tax to the national exchequer in 2013 than in the previous year due to an increase in their bad loans and shrinking of business owing to political turmoil.

Last year, banks deposited Tk 6,091 crore to the state coffer as corporate tax, according to a finance ministry report placed in parliament last month.

The National Board of Revenue collects 60 percent of its total income tax from corporate tax, with banks being a major contributor.

But due to political unrest and corruption, banks' income from commission and service charges fell and their default loans increased, which shrank the banks' interest income.

The rise in bad loans meant banks had to make provisioning against bad loans from their lower incomes.

However, the private and foreign banks, which typically pay the highest corporate tax, paid more or less the same amount as the year before.

In 2013, private banks gave corporate tax of Tk 4,448 crore, which was Tk 4,446 crore the previous year. Foreign banks paid Tk 1,268 crore last year in contrast to Tk 1,221 crore in 2012.

It was the state banks which slacked the most in terms of corporate tax: they paid Tk 375 crore only last year, against Tk 3,370 crore the year before.

The state banks' profits fell drastically after a number of big scams including the one involving the Hall-Mark group were unearthed.

Sonali Bank did not pay any tax in the last three years, while Janata paid only Tk 257 crore last year, which was Tk 3,081 crore the previous year, according to the finance ministry report.

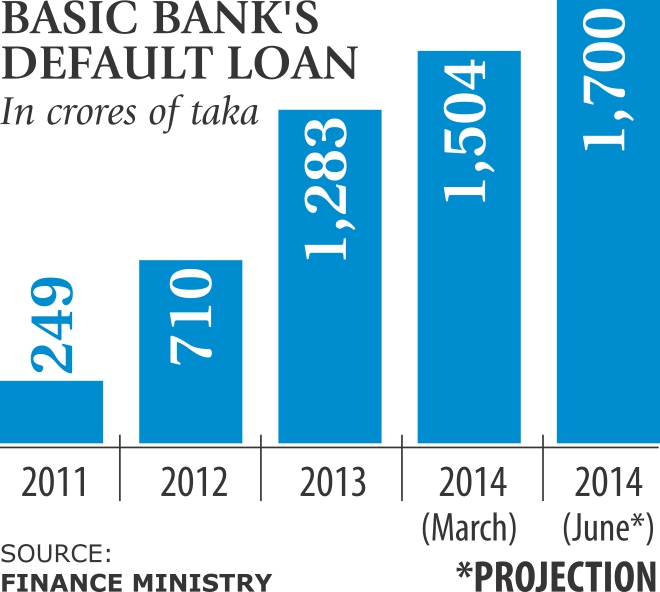

Another scam-hit bank BASIC paid only Tk 55 crore in 2013, half of what it paid in 2012.

An NBR official said the shortfall in tax collection from the target in recent times is mainly due to a fall in collection from banks.

The official said there is little scope for banks to evade tax as their balance sheet is made maintaining a proper accounting system.

Meanwhile, banks expressed dissatisfaction about the continued high corporate tax for them. They now pay 42 percent tax, but were assured by many top level government officials that it would be reduced in the new fiscal year that begins today.

However, it remained unchanged in the finance bill passed in parliament on Saturday.

Helal Ahmed Chowdhury, managing director of Pubali Bank, told The Daily Star that the banks expected the corporate tax to be brought down to 40 percent. He said if that was done it would have a positive impact on lowering the interest rate.

Not only do the banks pay 42.5 percent corporate tax, they also pay other taxes.

“Given the overall backdrop the government should consider lowering the corporate tax,” he added.

Comments