BB raises policy rates Overall inflation eases a bit in Dec, non-food inflation rises

The central bank yesterday increased its policy rates by around 50 basis points at the beginning of New Year when non-food inflation has been rising alarmingly.

The central bank yesterday increased its policy rates by around 50 basis points at the beginning of New Year when non-food inflation has been rising alarmingly.

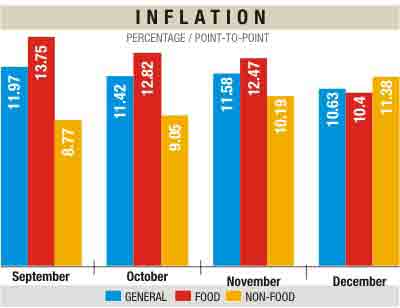

Food inflation always increases more than the non-food inflation. But in December, non-food inflation crossed food inflation for the first time on a point-to-point basis and reached 11.38 percent as diesel and electricity prices went up.

Bangladesh Bureau of Statistics (BBS) yesterday released the inflation data for December, which shows food inflation stood at 10.40 percent.

In December, food inflation fell by 2.07 percentage points while non-food inflation went up by 1.19 percentage points in November.

The BB increased the repo rate from 7.25 percent to 7.50 percent and hiked the reverse repo rate to 5.75 percent from 5.25 percent.

The repo rate is an interest rate at which the central bank lends money to commercial banks. The reverse repo rate is the return banks earn on excess funds parked with the central bank.

In recent times, non-food inflation has been on the rise, and to cut back such inflation the repo rate was increased, said a central bank official.

The IMF mission that visited Bangladesh last month also advised to increase repo rate.

The BB official said they made the credit costlier by increasing the policy rates so that high credit growth takes place.

He said only a fall in private sector credit will not work. Government borrowing has to be cut at the same time, he added.

The central bank last year increased the policy rates four times.

According to the BBS, the overall inflation rate decreased by 0.95 percentage point from November and stood at 10.63 percent in December due to a fall in food inflation.

A good aman harvest and a fall in the prices of winter vegetables brought down the food inflation, said BBS Director General Shahjahan Ali Mollah yesterday.

Mollah said a hike in power prices increased the non-food inflation rate.

An official of the finance ministry said fuel prices were hiked in four phases last year, and power tariff was raised twice which impacted on the rise of non-food inflation. He also blamed fuel price hike on such inflation.

House rent went up by about 16 percent last year, according to the statistics of Consumers' Association of Bangladesh (CAB).

Besides, the taka was devalued by about 17 percent against the US dollar in last one year which also fuelled non-food inflation.

The Daily Star/Bangladesh/ 5th Jan 2012

Comments