BB asks banks to bring back export proceeds fast

Posted by on Thu, Oct 06 2011 02:17 am

In the face of a mounting pressure on the foreign currency reserve, the Bangladesh Bank yesterday directed all commercial banks to quickly bring back their export proceeds.

BB Deputy Governor Ziaul Hasan Siddiqui along with other high officials sat with the chief executive officers of the commercial banks at the central bank yesterday.

The central bank at the meeting also directed the exchange houses of the commercial banks to refrain from any unhealthy competition so that the taka-dollar exchange rates do not go up abnormally.

Last month, the visiting International Monetary Fund mission also expressed concern over the falling balance of payments (BoP) and foreign exchange reserve of the country.

The IMF team also recommended the government take a good number of steps in this regard.

The government has also started feeling the pressure and sought fresh support of $1 billion from the IMF about which the finance minister presented the government's case in the World Bank (WB) and IMF annual meeting last month.

The foreign currency reserve was at $9.88 billion yesterday, down from $10.91 billion in June.

The reserve crossed the $10 billion mark in October 2009 and at one point it reached $11 billion last year.

However, the IMF said the foreign exchange reserve of Bangladesh may dip to $8.2 billion at the yearend due to the pressure on the BoP.

The pressure on the BoP also pushed up the taka-dollar exchange rate.

On September 27, the exchange rate was on an average Tk 75.18, up from Tk 74.23 in June last year. On September 27 last year, the exchange rate was Tk 69.86.

The high exchange rate is a concern for the central bank as the rising trend pushes up inflation further and directly hit the poor.

An official of the central bank said the BB is taking various steps to reduce the pressure on the BoP, and sat with the banks yesterday as part of the ongoing process.

The official said export proceeds usually reach the country within 120 days of export. The BB has advised the banks to bring in the export proceeds before the deadline so that the banks can make the import payment from their own income.

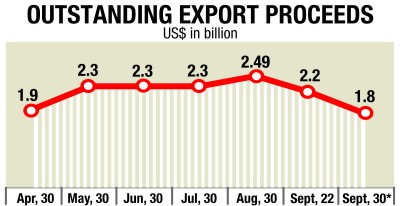

Outstanding export proceeds, except those from the export processing zones, reached $2.49 billion in August. However, the amount came down to $1.8 billion on September 30.

The central bank also observed that the exchange houses of some banks are quoting high rates for bringing in money from expatriates through their banks, which in many cases is heating up the market.

In a bid to ease the stress on imports, which will help reduce the pressure on the BoP, the BB also asked the banks not to go for any unnecessary import.

However, BB Governor Atiur Rahman told The Daily Star that the central bank has not put any stress on the banks.

The BB has advised the banks so that their role does not distort the market.

The central bank governor also said the BB has taken several steps to reduce the pressure on the BoP.

The pressure would ease significantly by the yearend, the governor added.

Atiur said rice import has come down and the prices of different commodities are falling on the international market. As a result, a good situation is expected in near future, he said.

On the declining foreign currency reserve, Atiur said: "It will sometimes increase and sometimes mark a fall."

He said, “The reserve is built up so that it can be utilised at the time of need and the issue has to be seen in that light.”

News: Daily Sun/ BAngladesh/ Oct-06-2011

Comments