BASIC Bank default loans growing fast

The default loans of BASIC Bank growing abnormally fast in the recent months as loans the bank had disbursed through irregularities are getting matured.

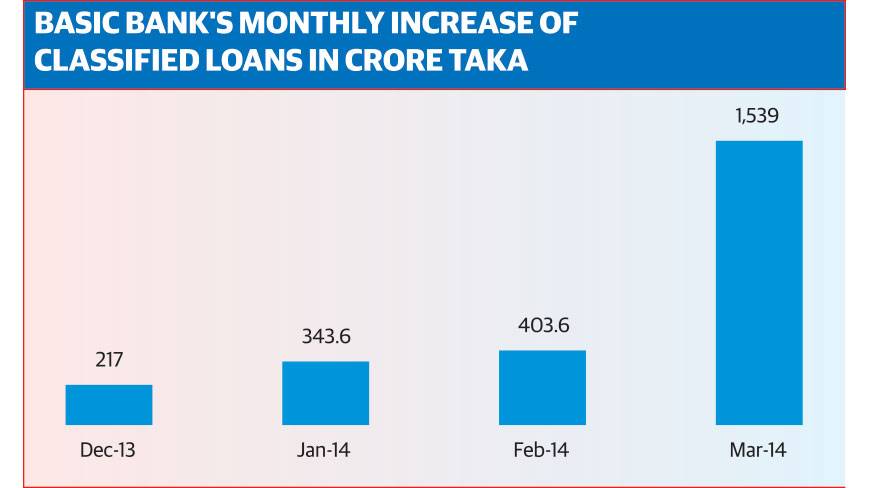

In March only, it rose by Tk1,140 crore or more than 80% to stand at Tk2,557 crore from Tk1,417 crore in February as the newly classified loan increased by Tk1,539 crore in March.

Maximum of the loan the bank disbursed violating the rules and without proper documents in the year 2009 to 20012. This resulted in the abnormal growth of the default loans every month, said a senior executive of Bangladesh Bank.

The increasing trend of the classified loan is the continuous effect of earlier loan forgery which has eroded the financial health of the bank gradually, he said.

The amount of new classified loan was Tk217.5 crore in December last and it rose to Tk343.6 crore in January, Tk403.6 crore in February and Tk1,539 crore in March, according to the latest statement (unaudited) BASIC Bank submitted to Bangladesh Bank.

The total classified loan of the bank increased by 99% to Tk2,557 crore in March from Tk1282 crore in December 2013.

The outstanding loan with the top 20 defaulters stood at Tk915 crore in March from Tk880 crore in December, against almost zero recovery from the defaulters.

Bangladesh Bank signed a MoU with the bank to recover its financial health in September last year but the bank could not come out from the sorry state due to drastic increase of classified loans, said a senior executive of Bangladesh Bank.

Moreover, all the financial indicators of the bank became negative day by day due to further irregularities in loan disbursement after signing the MoU.

As a result, the deposit growth fell sharply as the depositors lost confidence on the bank, he said.

The deposit growth of the bank was 58% in July 2013, but came down to 1.65% in December last year. The growth turned negative by 2.49% in January, 0.43% in February and 0.61% in March.

The bank also took the highest advantage of relaxed loan rescheduling rules to reduce the burden of classified loan in December last.

The bank rescheduled classified loan of Tk1,151 crore in December. As a result, the total classified loan of the bank reduced to 11.82% in December from 18.43% in September last year. But the amount of classified loan further rose to 23% in March due to the increasing newly classified loans, according to the Bangladesh Bank data.

News:Dhaka Tribune/27-May-2014

Comments