Banks’ H1 profit shines, but fails to lift stock prices

Because there is still a big challenge ahead as curse of NPL is hovering over banks’ head’

Net profit of nearly 80% of the listed private banks have increased in the first half of this year due mainly to higher income from treasury bonds and improved import situation.

Bankers said loan rescheduling against Non-Performing Loans (NPL) have also helped increasing the net profit, but NPL is still a headache as it will have to be adjusted at the end of the year.

They, however, hoped the earnings would be better in the days to come if the political situation remains in favour of investment.

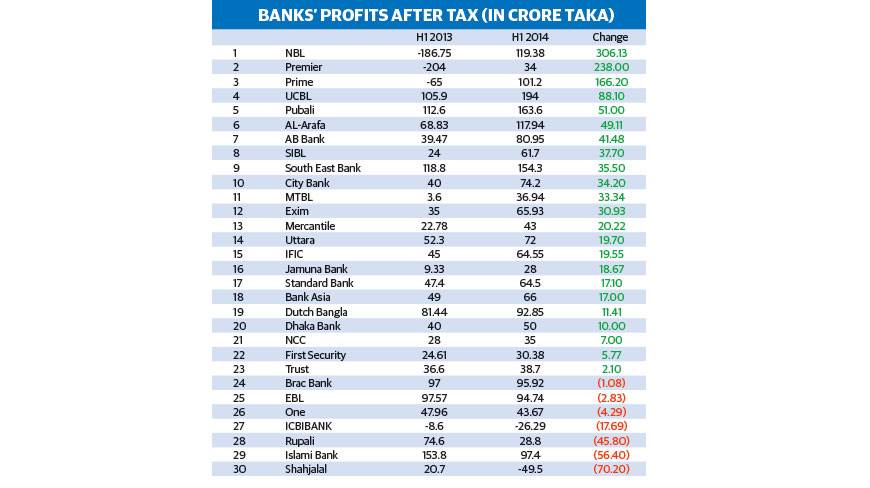

Of the 30 listed banks, the net profit of 23 marked rise, five saw a fall and two incurred losses in the January to June period, according to Dhaka Stock Exchange (DSE) data.

Pubali Bank Managing Director Helal Ahmed Chowdhury said some banks recovered well from their poor earnings last year hit by the political unrest.

He said the banks have earned the lion’s share of income from investment in government treasury bonds. “It gives a big support in boosting earnings as rate of interest of bonds was higher in the last quarter.”

Some supports also came from realising commission from opening LC (letter of credit) that rose in the recent months, and remittances, he said.

Imports rose by 20.7% in the last fiscal compared to the previous fiscal. In June this year, the opening of LCs posted a rise of about 31% compared with that of a negative growth of 17 % in the same month of 2013, according to Bangladesh Bank.

Mutual Trust Bank Limited (MTBL) Managing Director Anis A Khan said mainly expansion, diversification and restructure of planning has helped bringing good results. “Banks’ investment in Treasury bonds with high call rate has helped recovering well in the recent times from last year’s dismal earnings.”

The banker said the impact of loan defaults, which shot up last year following a series of banking scams and political unrest, might improve this year too, if political field remains calm.

Chowdhury said rescheduling NPL in line with the central bank rules helped banks keep lower provisioning, also contributing to the profits. “But there is no reason for complacency. Because there is still a big challenge ahead as curse of NPL is hovering over banks’ head.” About NPL, Khan said it followed last year’s trend.

The banks registered increased earnings by more than 100% are MTBL, Jamuna Bank, Social Islami Bank Ltd (SIBL), National Bank and AB Bank.

The banks with increased earnings by more than 50% are UCBL, Mercantile, Exim Bank, City Bank and Al-Arafah Bank.

The banks that saw a decline in their net profit are BRAC Bank, EBL, Islami Bank, One Bank and Rupali Bank.

Shahjalal Bank incurred losses of Tk49.5 crore in the first half of this year against its net profit of Tk20.7 crore a year earlier. During the period, accumulated losses of ICB Islami Bank rose to Tk26.3 crore, which was Tk8.6 crore.

Despite majority of banks registering increased net profit, they failed to attract stock investors. Yesterday, share prices of banks – the stock market’s bellwether – dropped 0.4%.

“It is probably because of bad loan,” said Asad Khan, managing director of Prime Finance and Investment Ltd.

He said banks enjoy loan rescheduling facility against bad loan, giving a boost to income. But at the end of the year, bad loan will be adjusted with the profits. Failure in bad loan recovery means negative impact on profit.”

News:Daily Sun/5-Age-2014

Comments