AL government's big election budget today

Salaries, interest payments, subsidies to eat up more than half of non-development expenditure

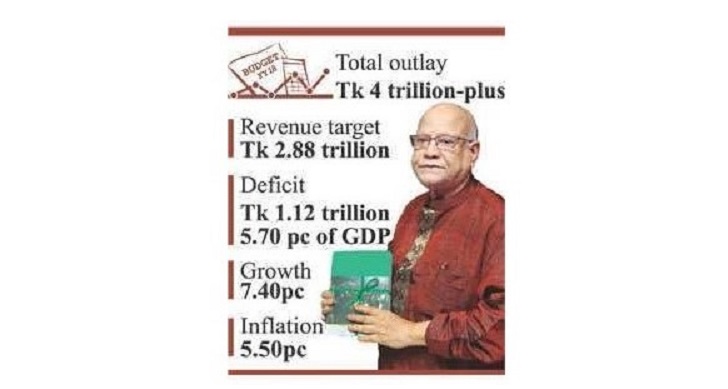

The Awami League-led government presents today (Thursday) its final full-scale budget before the next polls with an up-raised outlay of over Tk 4.0 trillion -- foreshadowed by strains on some economic indicators.

Economists foresee some major macroeconomic concerns in the coming financial year, beginning July 01, with possible impact on aggregate demand that gauges economic health.

Finance Minister AMA Muhith is set to place the national budget over Tk 4.0 trillion, which is equivalent to less than 18 per cent of Bangladesh's GDP or gross domestic product.

It happens to be last full-pledged budget in the Awami League-led government's present tenure, as the next general election is due halfway through the financial year 2018-19.

Muhith hinted in a pre-budget discussion that the size of block allocation would rise significantly. Economists always oppose such allocation of money that goes for catering extra fund demands that lack transparency.

The economists, however, said budget outlay should be focused on investments as a means to stimulate demand in the economy as many a key economic indicator -- export, remittance and current-account balance -- fares not so well.

Mr Muhith is set to place his consecutive ninth budget in the National Parliament from 01:30 pm with power-point presentation on the crucial yearly spending plans for the nation.

Many believe achieving a Tk 2.88-trillion total revenue target could prove a daunting task for the government as it expects higher receipts from VAT sources under a new law which will be implemented from the next financial year after its passage in Parliament way back in 2012.

The total revenue will have to be increased by 29 per cent to make it around Tk 2.88 trillion.

A big chunk of the money will come from the National Board of Revenue (NBR), which is eyeing a 34 per cent enhanced collection of Tk 2.48 trillion. The remainder will come from non-tax revenues like profits and dividends of government-owned enterprises, and the third-biggest sources is non-NBR.

The deficit worth Tk 1.12 trillion, which is equivalent to around 5.7 per cent of GDP, will be financed from both internal and external sources.

Of the total budgetary outlay, Tk 1.53 trillion would be set aside for development expenditure and the rest for non-development spending.

Salaries and allowances of government staff, interest payments and subsidies account for more than half of the non-development expenditure.

However, revenues from export proceeds, if export growth falls further, will shrink in the next financial year and expected revenues from direct taxes may not be achieved if the investment and other private-sector activities do not pick up.

The finance minister will be looking for means to boost public spending for achieving higher economic growth at 7.4 per cent as the private sector still grows at much slower pace than expected.

The government expects the GDP in nominal terms at Tk 22.243 trillion at the end of the financial year to June 30, 2018.

It also wants to keep the rate of inflation pegged to 5.5 per cent on average for next financial year although the prices of major staples are rising in recent months.

The much-talked-about new VAT system, under a law adopted in 2012, is ready for enforcement from July 01 as all preparations have been completed to this end.

The indirect taxation has direct bearings on the life and livelihood of every consumer as it is they -- already bearing the pinch of high inflationary pressure on some goods -- who are to pay ultimately.

A possibility of lowering the rate of VAT from 15 per cent to 12 per cent, considering demand from the business community, is cloaked in confusion as the finance minister lately gave the cold shoulder.

Currently, varied rates of supplementary duty are imposed on 1362 products at import and supply levels. And if they are withdrawn under the VAT act, then it will give less protection to the local industries.

Under the new law, supplementary duty can be slapped on a maximum of 170 goods and three services.

Although there are no significant developments in execution of the mega-projects, the budget proper will continue to boost the infrastructural development in the run-up to the next polls.

Economists say public expenditure is required to boost private investment but the former must be qualitative.

In their pre-budget thoughts they also stressed the need for effective implementation of major infrastructure projects for firing up economic growth which has been set at 7.4 per cent for the next fiscal.

Dr Ahsan H Mansur, executive director at the Policy Research Institute of Bangladesh (PRI), told the FE that quality public investment is an imperative to crowd in private investment.

The economist, however, sees challenges on both sides -revenue mobilisation and expenditure.

He said the revenue being expected from VAT Act implementation will not be so high in first year.

"It will take time to get expected level of revenues from VAT sources," Dr Mansur said.

The government would also not undertake any other major reforms in the budget to boost its revenues.

Banking sector is a major source of revenue income. In the current budget, the corporate tax on the sector got reduced by 2.5 per cent. It might be withdrawn in the next budget.

Dr Zahid Hussain, lead economist at the Dhaka office of the World Bank, told the FE that the public investment may be a tool for boosting the aggregate demand in the economy.

"We also need to think about the Haor people to address their basic needs, and effective social safety net is a must there," he noted.

Dr Hussain feels the urgency of big reforms to accelerate the economic growth.

Other Posts

- 60% increase in excise duty on bank accounts

- Underperforming banks should merge

- N Korean intelligence behind BB heist: Russian expert

- Muhith lays down plan for jobs, an economist doubts

- State-owned banks to get Tk2,000cr to meet capital shortage

- Govt requests ADB to finance private sector enterprises Govt requests ADB to finance private sector enterprises

- Budget: Keeping money in bank to cost more

- BIDA takes stock of doing business reforms in Bangladesh

- Arastoo Khan, Chairman of Islami Bank Bangladesh Limited, presiding over a Board of Directors meeting at the bank head office in the city on Wednesday. Md Abdul Hamid Miah, Managing Director and directors of the bank among others were also present.

- Md Habibur Rahman, Managing Director of Al-Arafah Islami Bank Limited, handed over a cheque of Tk. 5 lakh for giving scholarships to poor and meritorious students to M Shahidul Islam Chowdhury, former Inspector General of Police and President of Banglades

Comments