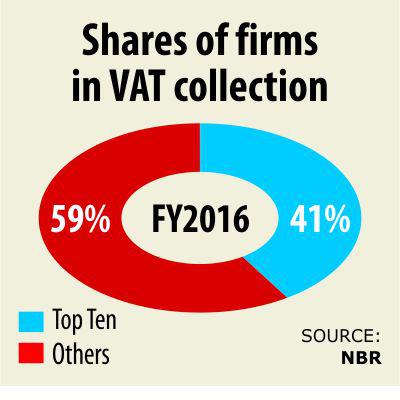

Some 40 percent of the total value-added tax and supplementary duty collected in a year by the National Board of Revenue comes from only 10 firms -- a startling detail for a $220 billion economy that is growing fast.

The companies are from cigarette, gas, mobile operator and power sectors, according to data from the Large Taxpayers' Unit, VAT.

The disclosure also suggests extensive tax evasion by others.

“This indicates that VAT and SD collection from domestic economic activities is vulnerable to the fortunes of a few institutions,” said Zahid Hussain, lead economist of the World Bank's Dhaka office.

Bangladesh has 8.5 lakh firms registered under VAT but only 32,000 submit returns and pay VAT, much to the vexation of Finance Minister AMA Muhith.

“This makes it clear that VAT is confined to a limited area,” Muhith said in his budget speech last month.

Data showed that 157 firms accounted for 55 percent of the total of Tk 56,080 crore collected as VAT and SD from domestic economic activities in fiscal 2015-16.

Of the sum, Tk 30,417 crore came from LTU-VAT, 75 percent of which, in turn, were from 10 firms.

VAT paid by the top revenue-generating firms such as British American Tobacco, Dhaka Tobacco Industries, Petrobangla, Grameenp-hone and Titas Gas stood at Tk 26,045 crore in the first 11 months of fiscal 2016-17.

The amount was 72 percent of the total VAT collected by the LTU in the just concluded fiscal year, according to preliminary data released by the NBR.

Data by the NBR's field office also showed that five sectors -- cigarettes, gas, mobile operators, pharma-ceuticals and banks -- provide 88 percent of the LTU's total collection in a year.

“This indicates the narrowness of the existing tax base and the scope to evade VAT,” Hussain said.

The tax base is narrow because of the prevalence of different rates of VAT under the VAT Act 1991. As a result, there is scope for discretion by revenue officials and it creates grounds for corruption.

The state becomes a loser as all the indirect tax paid by taxpayers does not make it to the coffer in the end, the WB economist said.

“This also explains the recent resistance from many businesses against the implementation of the new VAT law that aimed at eliminating multiple rates and limiting discretionary power of revenue officials,” he added.

In the face of opposition from many businesses, the government has shelved its plan to implement the much talked-about VAT and SD Act 2012 for two years.

The legislation, which was framed to increase domestic revenue collection by tapping all areas of the economy, bring transparency and accountability in revenue administration and curb evasion, was planned to take effect from this month.

Revenue collection would rise if the commissioners at field offices curb evasion and collect VAT properly, said a senior NBR official.

“There are hundreds of businesses that escape payment of actual amount of VAT because of corruption among a section of revenue officials.”

Subsequently, the official suggested strengthening the VAT intelligence office to curb evasion.

A major chunk of revenue usually comes from large firms in every country, said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

“For this reason, the LTU was formed -- to closely monitor the big firms.”

The implementation of the new law did not take off because of opposition of small firms, who now pay package VAT, which is essentially a discounted form of VAT, he said.

“These firms will not pay tax easily,” Mansur said, adding that they should be brought under the net gradually by insisting that they keep records of their transactions.

Like Hussain, Mansur also said the dependence on few firms and on a select few sectors to collect a big portion of VAT and SD is not healthy.

The top VAT and tax providers of every sector should be brought under the LTU through periodic surveys by the NBR, he said, citing the establishment of many hotels and resorts in recent years.

The contribution of gas, power, tobacco and mobile operators would be at best 15 percent of GDP, although they account for more than one-third of VAT and SD collected from domestic production in a year, said Towfiqul Islam Khan, a research fellow of the Centre for Policy Dialogue.

“It means that there is untapped potential for revenue mobilisation,” he said, adding that the leakages must be stopped.

Khan suggested reforms, digitisation of the revenue systems and expansion of revenue administration throughout the country to widen the tax base.

news:daily star/12-jul-2017

Comments